Washoe County Retirees

Medical - Dental - Vision

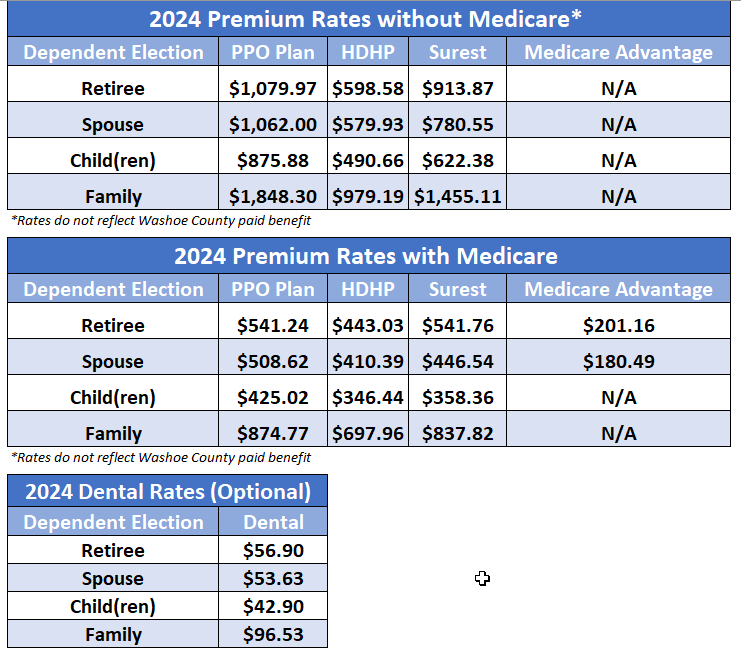

Washoe County offers its retirees comprehensive medical, dental and vision insurance coverage. Retirees have four health plans to select from:

- Self-funded Preferred Provider Organization (PPO)

- Sures Plan (Surest)

- High Deductible Health Plan with a Health Reimbursement Account

- Medicare Advantage Plan for those retirees and their dependents enrolled in Medicare

Self-funded Group Health Plan (PPO)

Self-funded Group Health Plan (PPO)

The PPO Plan is administered by UMR with the United Healthcare Choice Plus Network of Providers.

Prescription benefits under this plan are managed by MaxorPlus.

High Deductible Health Plan (HDHP) with a Health Reimbursement Account

High Deductible Health Plan (HDHP) with a Health Reimbursement Account

The HDHP Plan is administered by by UMR with the United Healthcare Choice Plus Network of Providers. The HDHP is paired with a Health Reimbursement Account (HRA) administered by American Fidelity Assurance Company.

Prescription benefits under this plan are managed by MaxorPlus.

A UMR Representative is available every Monday and Wednesday from 8 a.m. - 4 p.m.

Located in the Human Resources Office at 1001 E. Ninth St., Bldg. A, Room 220, Reno NV.

No appointment is needed.

Health Maintenance Organization (HMO) Plan

Health Maintenance Organization (HMO) Plan

This plan is administered by UMR with prescription benefits managed by Optum Rx.

The Medicare Advantage HMO Plan is administered by Senior Care Plus.

GAP Plan

GAP Plan

This GAP Plan is administered by American Fidelity Assurance Company, and is designed to help cover a portion of your out-of-pocket expenses with the HMO group health plan.

Dental and Vision Benefits

Dental and Vision Benefits

Self-funded vision benefits are administered by Vision Service Plan (VSP).

Dental benefits are optional for Retirees.

The self-funded dental plan is administered by UMR and the network of PPO dental providers is managed by Guardian.

Life Insurance

Washoe County provides basic life insurance coverage with a benefit maximum of $20,000. The benefit reduces to $13,000 at age 65 and $7,000 at age 70.

To enter/update life insurance beneficiary information, log into ESS, and select the Life and Work Events tab. Select the Beneficiary Change link and enter your beneficiary information.

ESS Life Insurance Beneficiary Instructions (printable version)

If you are unable to access ESS, please complete a Life Insurance Beneficiary Form and submit it to healthbenefitsmailbox@washoecounty.gov.

Supplemental life insurance is available for purchase; please see additional information under Supplemental Benefits web page.

PERS - Public Employees' Retirement System of Nevada

PERS - Public Employees' Retirement System of Nevada

The Public Employees' Retirement System of Nevada (PERS) administers the retirement plan.

- PERS Retiree Reemployment Notification (Non-PERS eligible position)

- PERS Re-Employed Retiree Earnings Limitation for FY 23/24

Deferred Compensation

Deferred Compensation

Washoe County's Deferred Compensation Program is administered by Voya.

If you are a participant in one of the Deferred Compensation Plans and would like additional information, please contact Voya's Retirement Readiness Service Center at 800-584-6001 or Voya's Representative, Tom Verducci at 775-530-3089. You may also access your account online at voyaretirementplans.com.

Deferred Compensation Plan FAQs